Need help constructing the call to the Clover REST API to get (Part 1) accurate and stable line item categories and (Part 2) distribute taxable/non-taxable sales within categories.

Currently we are using the Order API to collect individual orders within a single date, then aggregating this detail we finally determine a daily accounting record (EG. sales, sales tax, payments, tips, etc.)

Part 2

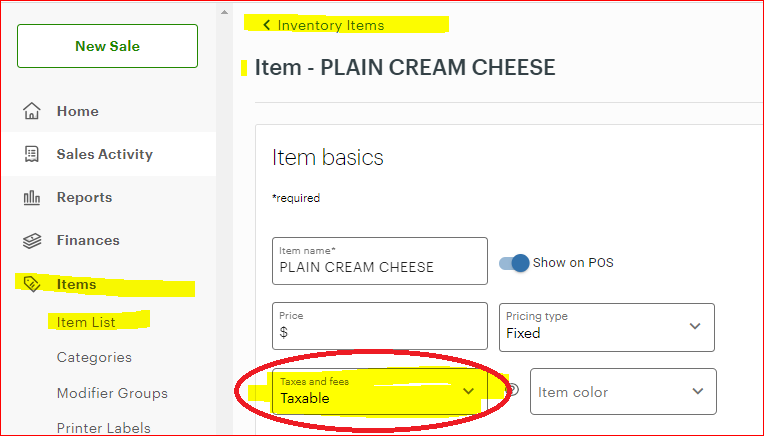

Inventory Items can be taxable or non-taxable. In the Clover GUI this is shown on any Inventory Item page (see screen shot below).

2) Where is the `Taxes and fees` property or which property in the Items API determines the `Taxes and fees` value? See example data from the Items API (Code Example 2 below).

CODE EXAMPLE 2 - Inventory Item example from the Items API

{

"id": "TWEVYAAD31Q7A",

"hidden": false,

"available": true,

"autoManage": false,

"name": "PLAIN CREAM CHEESE",

"alternateName": "",

"code": "",

"sku": "",

"price": 261,

"priceType": "FIXED",

"defaultTaxRates": true,

"unitName": "",

"cost": 0,

"isRevenue": true,

"stockCount": 0,

"categories": {

"elements": [

{

"id": "MFQA5EAXZSE6P",

"name": "FOO",

"sortOrder": 10,

"deleted": false

},

{

"id": "H462D82YQYZ34",

"name": "Bagels w/",

"sortOrder": 0,

"deleted": false

}

]

},

"modifiedTime": 1709141498000,

"priceWithoutVat": 0,

"deleted": false

},