Hi there.

We're facing a refund behavior which seems to incorrectly apply per-item taxes on refunded items, which subsequently causes Clover itemized sales reports to show incorrect information.

In short:

1. Create and pay for an order with 2 items : Pizza, $16.00 + $1.16 tax, Drink, $1.50, no tax.

Total for Order : $18.66

2. Refund the order. Sales report shows refunds:

Drink : $1.60 (should be $1.50)

Pizza: $17.06 (should be $17.16)

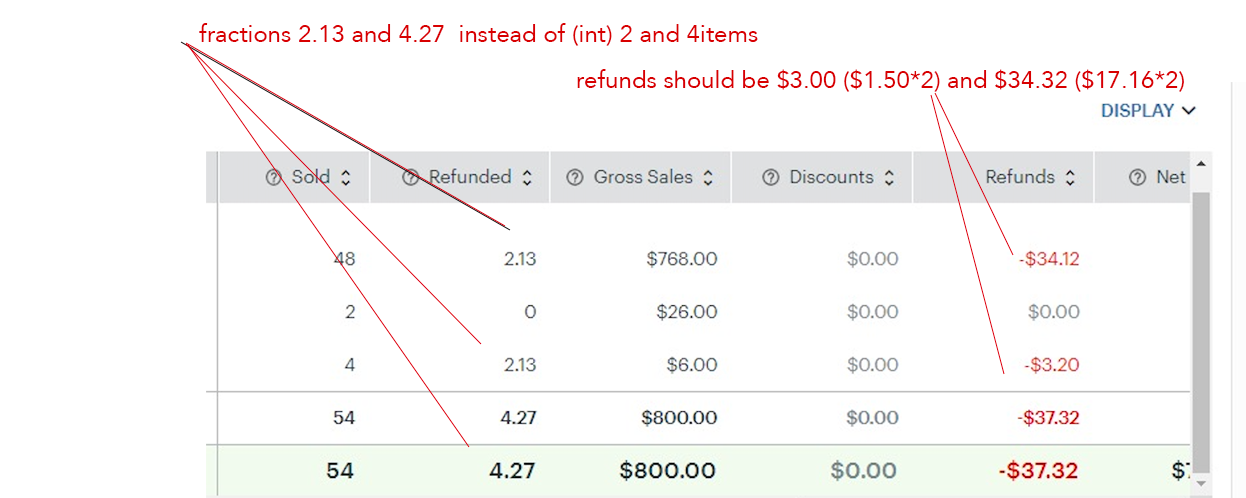

3. In addition, sales shows "fractional" item count for each sold and refunded item : 1.065 instead of "whole"

Screenshot below shows 2 such refunds (2 identical orders for $18.66)

It seems that during refund, tax amount ($.1.16) is split between all order items and applied to EACH item using the tax rate present in the order (on "Pizza"), despite the fact that "Drink" item has no tax rate.

***Update - this seems to happen on all orders with tax regardless whether there are "mixed" tax items in the order.

-----

Longer version with posts/reponses:

1. Create an item "Pizza" : $16.00 with 7.25% tax (rate: 725000 === $1.16)

2. Create another item "Drink" for $1.50 without tax

3. Create atomic order (taxes are applied per product)

Response (shortened)

{

"id": "TH3W*****",

"total": 1866,

"paymentState": "PAID",

"taxRemoved": false,

"state": "locked",

"payType": "FULL",

"lineItems": {

"elements": [

{

"id": "BFZ*****",

"item": {

"id": "SRM*****"

},

"name": "Pizza",

"price": 1600,

"taxRates": {

"elements": [

{

"id": "BQ2*****",

"lineItemRef": {

"id": "BFZ*****"

},

"name": "Sales Tax",

"rate": 725000,

"isDefault": false

}

]

}

},

{

"id": "ANMK*****",

"item": {

"id": "A0R*****"

},

"name": "Drink",

"price": 150,

"taxRates": {

"elements": [

{

"id": "SVQ*****",

"lineItemRef": {

"id": "ANMK*****"

},

"name": "NO_TAX_APPLIED",

"rate": 0,

"isDefault": false

}

]

}

}

]

},

"taxRates": {

"elements": [

{

"id": "BQ2*****",

"name": "Sales Tax",

"amount": 116

},

{

"id": "SVQ*****",

"name": "NO_TAX_APPLIED",

"amount": 0

}

]

}

}

4. Pay for the order v1/orders/{ID}/pay (taxes are applied per product)

Charge Response (shortened)

{

"id": "14C9****",

"order": {

"id": "TH3W****",

"currency": "USD",

"total": 1866,

"taxRemoved": false,

"state": "locked",

"payType": "FULL"

},

"amount": 1866,

"taxAmount": 116,

"offline": false,

"result": "SUCCESS",

"taxRates": {

"elements": [

{

"id": "SVQM****",

"paymentRef": {

"id": "14C9T****"

},

"name": "NO_TAX_APPLIED",

"rate": 0,

"isDefault": false,

"taxableAmount": 150,

"taxAmount": 0

},

{

"id": "BQ2T****",

"paymentRef": {

"id": "14C9T****"

},

"name": "Sales Tax",

"rate": 725000,

"isDefault": false,

"taxableAmount": 1600,

"taxAmount": 116

}

]

}

}

5. Refund the order via v1/refunds with the above "charge.id " and $18.66

{

"id": "A7K86***",

"orderRef": {

"id": "TH3W***",

"currency": "USD",

"total": 1866,

"taxRemoved": false,

"isVat": false,

"state": "locked",

"payType": "FULL"

},

"amount": 1866,

"payment": {

"id": "14C9T3***",

"order": {

"id": "TH3WS***"

},

"amount": 1866,

"tipAmount": 0,

"taxAmount": 116,

"result": "SUCCESS"

},

"lineItems": {

"elements": []

},

"taxableAmountRates": {

"elements": []

},

"voided": false,

"status": "SUCCESS"

}