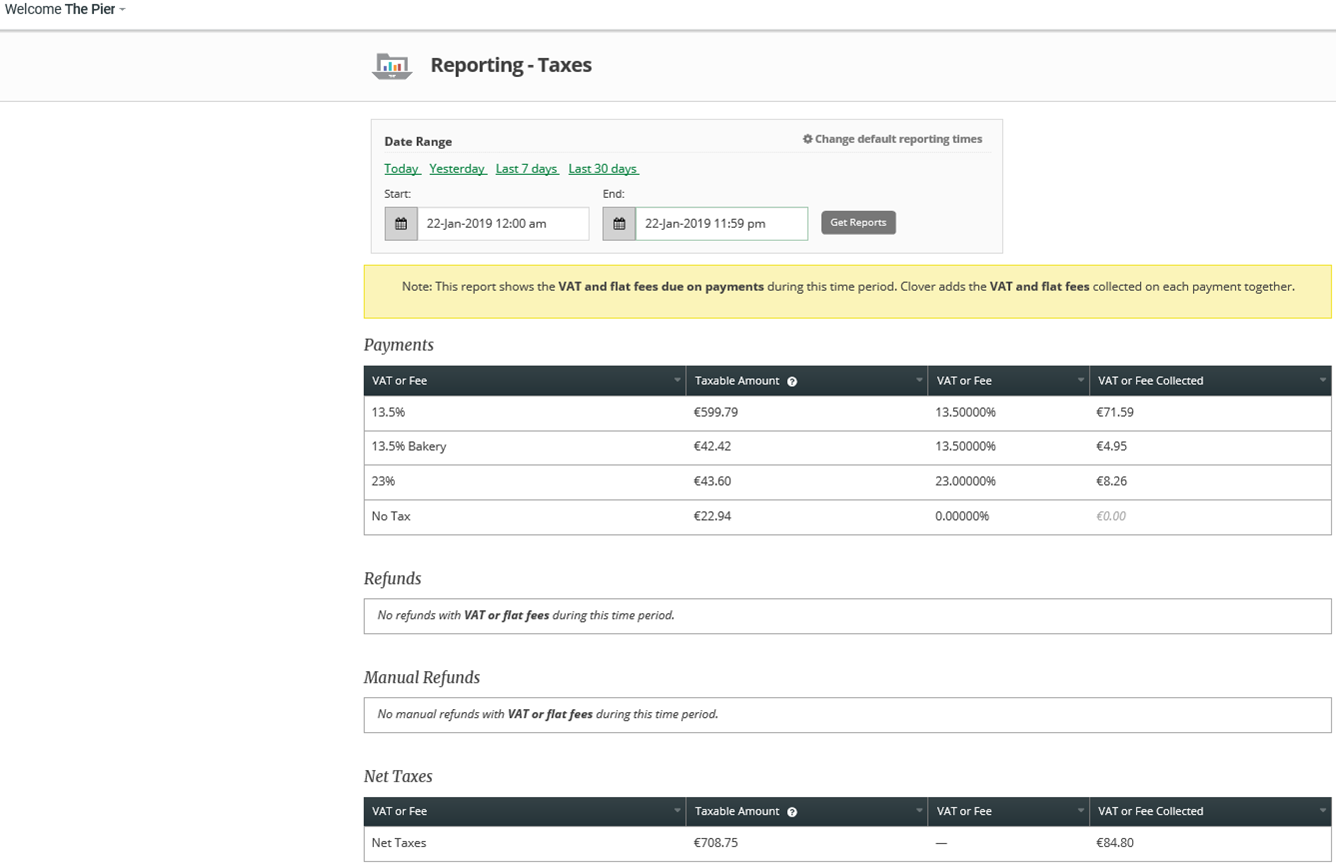

Just to take the first line item as an example. The calculated VAT is €71.51, however when you do the calculations manually i.e. 599.79 / 113.5 * 13.5 = €71.34. So the actual VAT should be 71.34 vs what Clover is showing 71.51.

Can you explain what is causing the difference?

VAT or Fee

Taxable amountVAT or FeeVAT or Fee Collected13.5%€599.7913.50000%€71.5113.5% Bakery€42.4213.50000%€4.9523%€43.6023.00000%€8.26No Tax€22.940.00000%0

Update:

I have followed up the theory that this is a rounding issue related to each individual order item. I've gone through the day in question, and other days too using the "Export individual line items" report from the Orders section in the Dashboard.

Even with this data I cannot re-calculate the summaries in the report above. If for example I go through every single line item on the day sold at 23% the sum of the "Tax Amount" column in the export is €8.28 rather than the dashboard report (€8.26) or the unrounded amount (€8.156585).

I've attached the line items report with my calculations. lineitemsexport-20190724-1103-ist.zip

@jacobabrams - this might be a question for you as I've seen some of your responses on similar topics