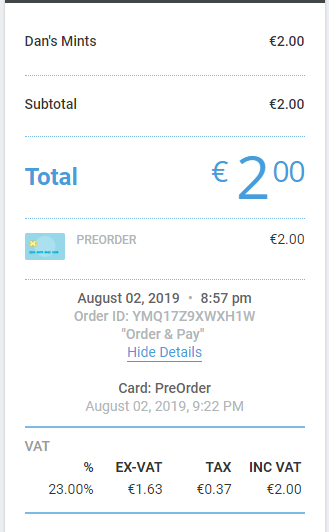

I was simply posting the ` tender.id`, `amount` and ` employee.id` and it managed to fully close out the order correctly. I can also see that the receipt is created sucessfully e.g.

As you can see the Tax is correctly calculated on the items and in the payment. However, if you look at the report online, the tax is not added to the end of day tax nor to the Report printout from the machine.

I have experimented a little and it is possible to add the `taxAmount` as another parameter to the tender, however I'm skeptical of doing this as it gets very complicated when looking at multipl items, multiple tax rates and dealing with it in different regions i.e. inclusive Europe and exclusive USA.

Is this inconsistency between the item level tax and the tax reports a bug? Or should I be manually calculating the tax and adding it to the payment myself?

Thanks!