Hello,

I'm having a problem with taxes. Basically I'm creating an Order with the REST API as follows:

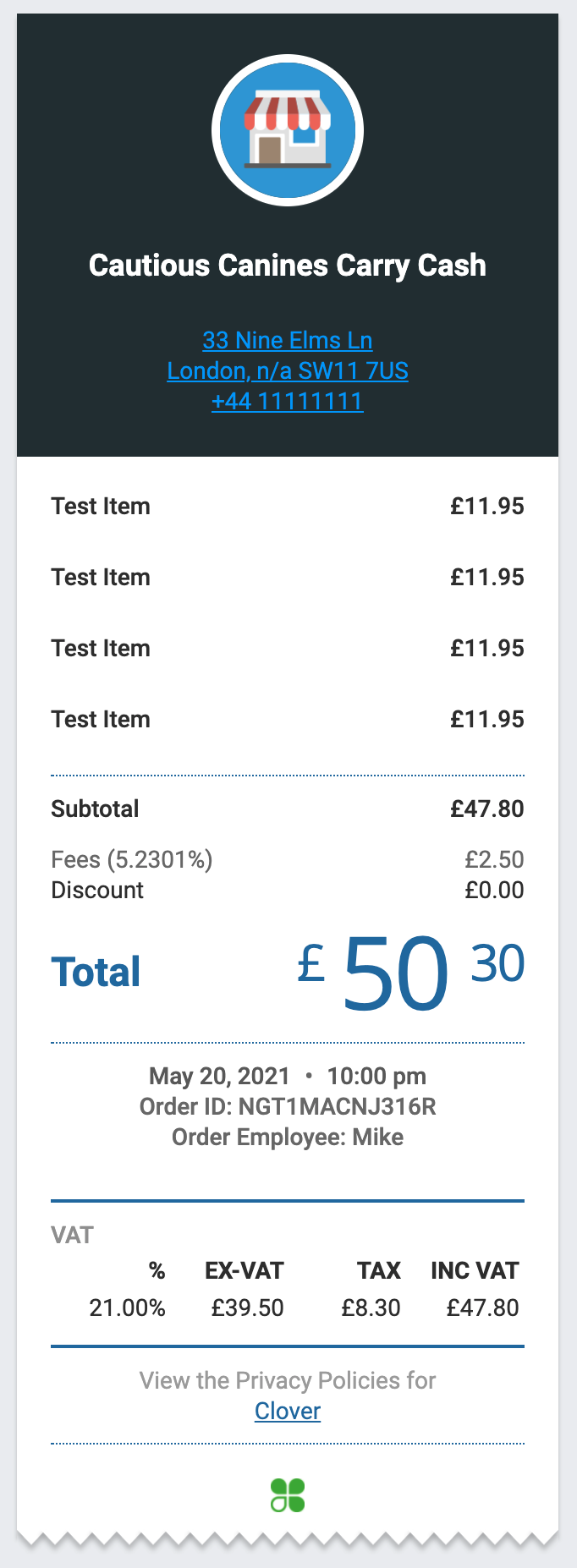

- Product A : 11.95$

- Product B : 11.95$

- Product C : 11.95$

- Product D : 11.95$

- Delivery fee as a service charge: 2.5$

Subtotal is 47.80$ as expected and the total is 50.30$

If I add a VAT tax fee to all of the 4 products that has a 21% value, the subtotal would remain the same but the total becomes 58.60$

I'm not sure how this calculation is done, shouldn't the total remain the same ? since we're only providing information about the tax ?

When I set the taxes, I still have the correct values for EX-VAT, TAX and INC VAT which are respectively 39.50$, 8.30$ and 47.80$ so I'm not sure what's the problem with the order total

Your help would be very much appreciated